One Firm

Every company has potential, but only a few fully realize it.

Olympus has a simple yet differentiated decision making process, grounded in our team work philosophy: Our Investment Committee meets everyday.

Critical issues are identified, discussed, ranked and investigated early and often. Our forward-thinking decision-making process accelerates the discussion of deal points, resulting in efficient use of resources, inclusive decision making across all levels, a broad range of perspectives, and most importantly, all Olympus professionals “owning” every deal.

The result: Olympus Partners operates as One Firm.

True Growth Partners

“We’ve been working with Olympus for several years, and truly appreciate their real partnering attitude. Since the first day, their entire team has remained highly engaged, alleviating the need to constantly re-educate them on our business objectives. They ask provocative questions and remain extremely supportive of management’s initiatives as our business outgrew its initial footprint. In addition to their strong knowledge of our industry and the capital markets, they are very well connected and can add real value. We find them to be genuine caring human beings who we enjoy sharing a glass of wine over dinner.”

Applying Best Practices

“When I decided to partner with Olympus, I wanted a private equity firm who would help me seamlessly spin out of the large multi-national that we were a part of and then help build the business. Olympus has greatly exceeded my expectations – we were able to completely separate from our former parent organization under budget and quicker than anticipated while at the same time dramatically growing our top and bottom lines. Drawing on their extensive experience with other human capital business they have also helped improve our strategies and some of our critical processes. I couldn’t be happier.”

Building a Great Company

“Acquisitions have been a big part of Tank’s success under Olympus’ first investment from 2008 through 2012 and acquisitions have been a driving force of the success that we have had since Olympus re-partnered with us in 2019. Olympus has helped us identify new and different channels that have really helped us transform the business since 2019. In addition to working with us to refine our acquisition strategy and identify targets, Olympus lets the management team do what we do best and minimizes the potential for disruption. Olympus’ knowledge of our company and markets and their appetite to continue our acquisition strategy have made them the ideal partner.”

Beyond the Investment Horizon

“Working with the team at Olympus was great. My entire team and the entire Olympus team had a wonderful relationship built upon openness, respect and not taking everything too seriously. They were very personable, which enabled us to connect on a personal level, talking about music, wine, or sharing stories about our respective families. Olympus helped us grow the business three fold in less than three years. Having now had experience working with seven different Private Equity funds I must say that they were the best of an already high quality group and we have remained friends and colleagues ever since.”

Forging New Paths

“Olympus has been an excellent partner in helping us transition Ritedose from simply a contract manufacturer to a generic drug company. They were instrumental in shaping the strategy for this new business model, and helped us quickly develop the necessary capabilities through their network of industry experts. Within three years, our direct sales business grew into a leading player in our category and accounted for nearly half the Company’s earnings. Olympus accessibility and responsiveness, as well as the analytical framework they helped us develop, allowed us to make quick decisions to capture this opportunity.”

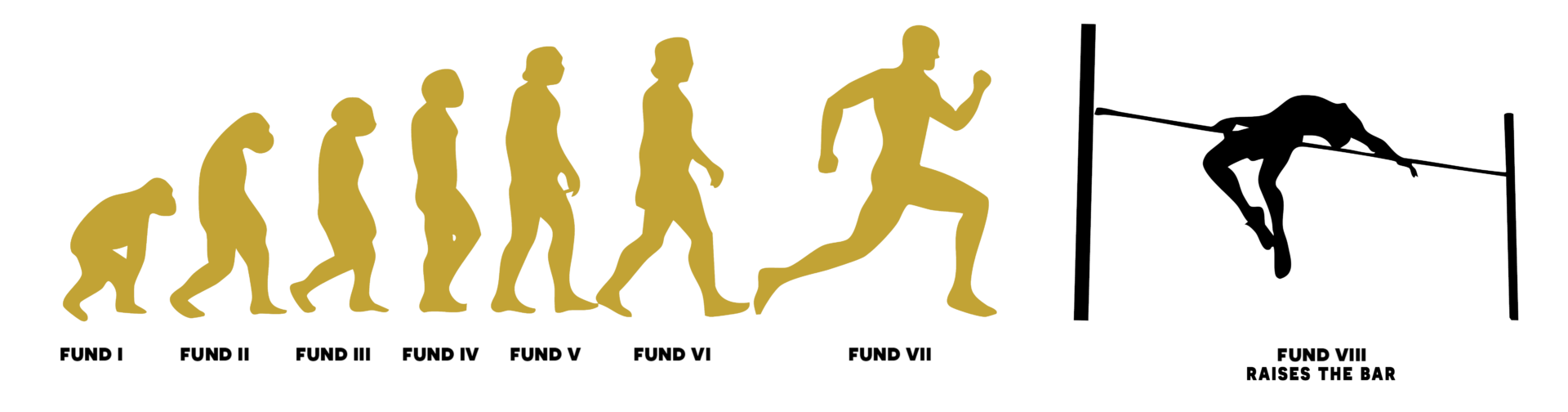

Darwin would be proud.

The evolution of the Olympus Partners funds.

Circumstances may change, however our Investment Philosophy has not.

Our strategy has stood the test of time. Since Olympus’ first $101 million fund in 1988 we’ve grown to over $12 billion of total committed capital.

Olympus General Partners have an average tenure of over 28 years and the average tenure across the entire investment staff is over 14 years. This same group has a proven track record across over 100 direct investments and over 190 add-ons completed by our portfolio companies.