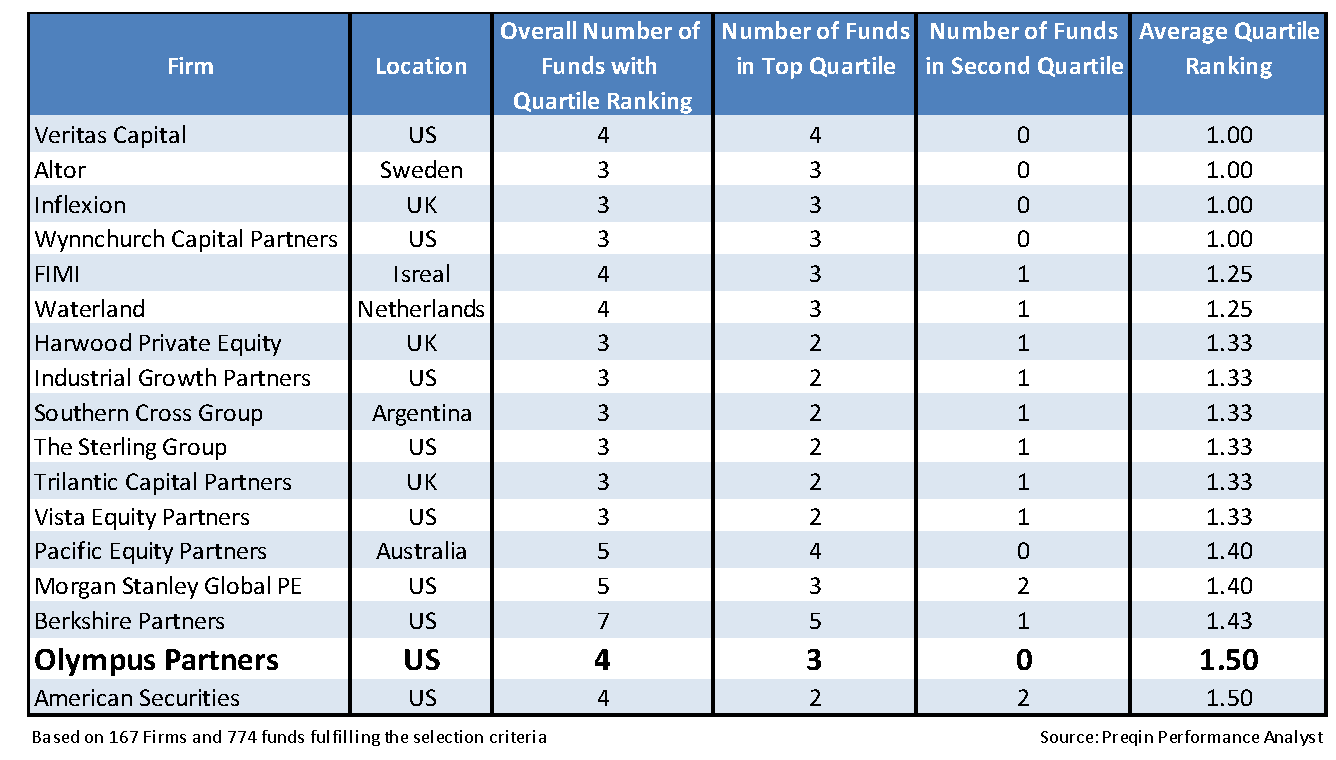

Stamford, Connecticut-based Olympus Partners announced today that it has been named one of top performing private equity fund managers in the world by Preqin, a leading source of information for the alternative assets industry. In 2014, for the third time, Olympus Partners was recognized in Preqin’s annual Global Annual Private Equity Report as one of private equity’s most consistent managers. Preqin says that “analysis of track record is a key component of any LP’s due diligence process, and while previous successful performance does not guarantee similar performance in the future, Preqin’s analysis has shown that the majority of managers with top-quartile performing funds have gone on to produce returns that beat the median benchmark with the next funds in their series.”

From The 2014 Preqin Global Annual Private Equity Report:

Founded in 1988, Olympus Partners is a private equity firm focused on providing equity capital for middle market management buyouts and for companies needing capital for expansion. Olympus is an active, long-term investor across a broad range of industries, including business services, restaurants, consumer products, healthcare services, and financial services. Olympus manages in excess of $5.5 billion on behalf of corporate pension funds, endowment funds and state-sponsored retirement programs.